SL Pay Terminal

SL Pay Terminal

The EC terminal for studiolution.

SL Pay Terminal

SL Pay TerminalThe EC terminal for studiolution.

No typing/ copying of prices needed. It’s a simplification and time saver for your daily business. Work even more conveniently with the studiolution.

Your customers can conveniently choose from 6 payment methods:

Günstiges und einfaches Preismodell ohne monatliche Fixkosten:

EC-Karten: ab 0,40 %, Kreditkarten: ab 0,99 % und Debit-Kreditkarten ab 0,79 % von der Zahlung + 9 Cent pro Transaktion (zzgl. MwSt.). Die Preise sind abhängig von eurem Umsatzvolumen.

Hinweis: Durchschnittlich fallen ca. 80% aller Zahlungen auf EC-Karten, 7% auf Debitkarten und 13% auf Kreditkarten (Stand 01/2024 SL Pay)

Umsatz / Monat | Girokarte | Kreditkarte | Debitkarte |

bis 5.000 € | 0,85 % + 9 Ct. | 1,29 % + 9 Ct. | 1,09 % + 9 Ct. |

ab 5.000 € | 0,75 % + 9 Ct. | 1,19 % + 9 Ct. | 0,99 % + 9 Ct. |

ab 10.000 € | 0,65 % + 9 Ct. | 1,09 % + 9 Ct. | 0,89 % + 9 Ct. |

ab 15.000 € | 0,55 % + 9 Ct. | 0,99 % + 9 Ct. | 0,79 % + 9 Ct. |

ab 20.000 € | 0,45 % + 9 Ct. | 0,99 % + 9 Ct. | 0,79 % + 9 Ct. |

ab 25.000 € | 0,40 % + 9 Ct. | 0,99 % + 9 Ct. | 0,79 % + 9 Ct. |

ab 30.000 € | 0,35 % + 9 Ct. | 0,99 % + 9 Ct. | 0,79 % + 9 Ct. |

The decisive factor for the classification is the turnover of the past month with studiolution Pay. Initially, the tariff scale “up to 5,000€” is always stored.

Always 100% fair: A change of scale is always made automatically at the beginning of the month. Upon presentation of appropriate evidence from the previous terminal provider, an appropriate scale can also be set in advance.

We do not believe in tying you to the SL Pay Terminal with long contracts. Costs are only incurred when it is used. That means no use or less use = no cost or less cost. So don’t worry if you take a break for a few weeks because of Lockdown or go on vacation.

There are also:

The SL Pay terminal not only eliminates the need to enter data into the EC device. You benefit from the all-round service through the complete integration in the studiolution cash register:

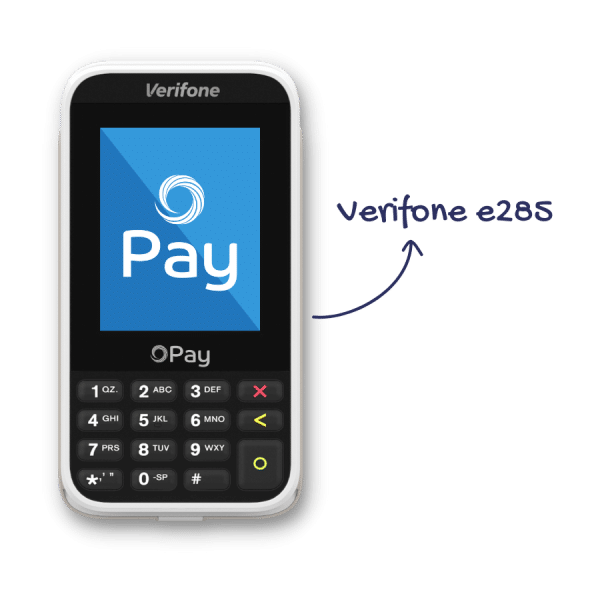

The extremely slim design of the

Verifone e285

makes the EC device extremely handy. The terminal does not contain an integrated printer, which is why it is so lightweight. In fact, the EC receipts are printed by the system together with the receipt via the receipt printer. If you don’t want to use paper at all, you can send the EC receipt together with the voucher by e-mail.

The terminal has a rechargeable battery and can therefore be used throughout the store. There is also no need for a second device, such as an iPad. The terminal works completely independently, you can walk with it in the whole store 😉

Wenn ihr eurem Terminal einen festen Kassenplatz geben möchtet und keine mobile Option benötigt, ist das Verifone P400 Plus die ideale Wahl. Dieses Terminal überzeugt nicht nur durch seine ansprechende Optik, sondern bietet auch eine zuverlässige kabelgebundene Terminallösung.

Wie beim anderen Modell, hat dieses keinen eigenen Drucker. Die Belege werden über euren Belegdrucker ausgedruckt.

PS: Falls ihr nach einer Alternative sucht, die ganz ohne Terminal auskommt, gibt es auch den SL Pay Link. Dabei erhalten eure Kund:innen einen Zahlungslink per SMS aufs Handy. Hier gibt’s mehr Infos.

The trend is moving more and more in the direction of credit cards. This is because modern payment methods such as Apple Pay and Google Pay are also based on credit cards. More and more people want to pay with it. What is clear is that the trend will not disappear again. We recommend you go with the trend, because it will raise your service level and look modern. Your customers are free to choose and can pay as they please.

Credit card fees are often the cost drivers for terminal fees. With our credit card fees starting at 0.99% of the payment + 9 cents per (plus VAT) transaction, we are significantly cheaper than many providers on the market.