“I am a craftsman and actually want to have as little to do with finances and accounting as possible ” – we often hear.

For most people, “finance” is a boring topic or something they would prefer not to have anything to do with – yet it is often precisely “finance” that holds the key to the success or failure of a company.

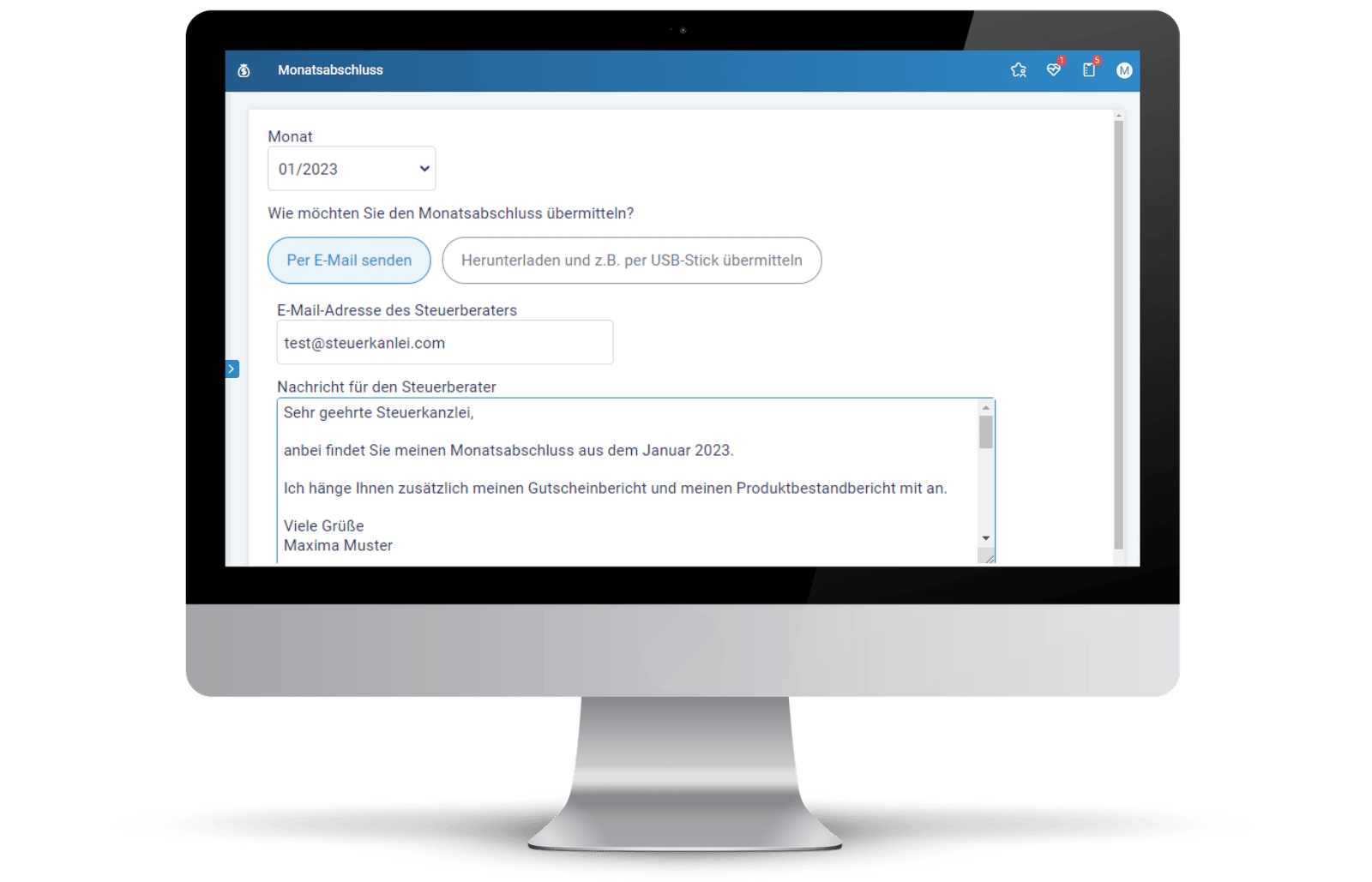

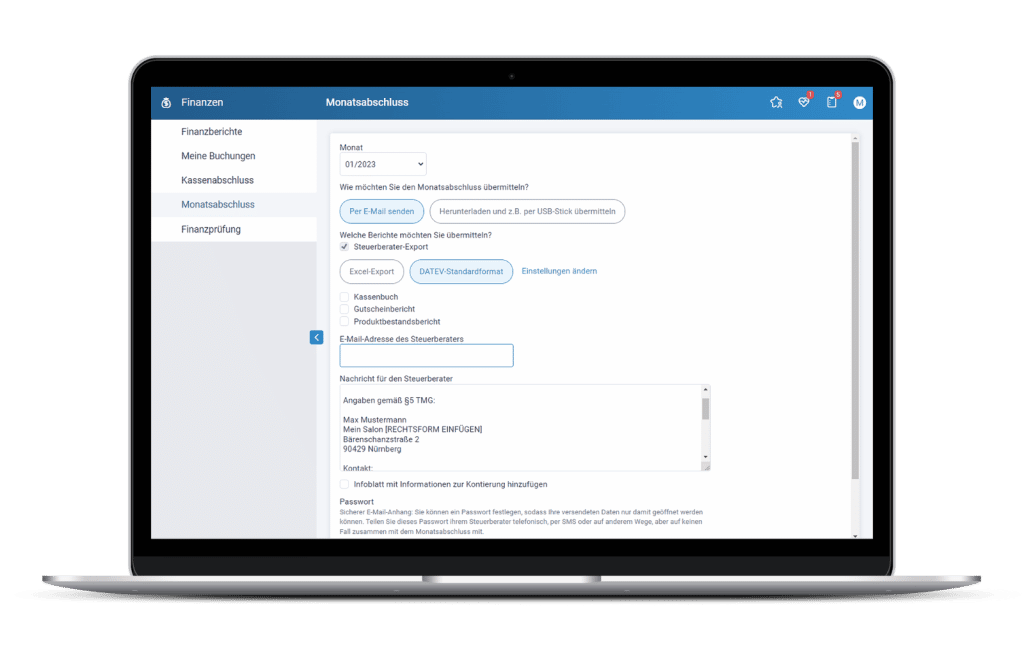

The studiolution cash register system combines both – “nothing to do with accounting” and still have the numbers under control.

Save time and nerves

Financial analysis

studiolution gives you answers to questions that really get you ahead with its financial analyses, such as:

That is, you know – and no longer just assume. You uncover weak points and can react in a targeted manner. No, financial analysis is not about doing the taxman a favor, it’s about getting better and generating more revenue.

In addition, there is a huge statistics section where all analyses are easy to read and just a click away.

Tip: You can support your price calculation with our service calculator. Take a look inside.

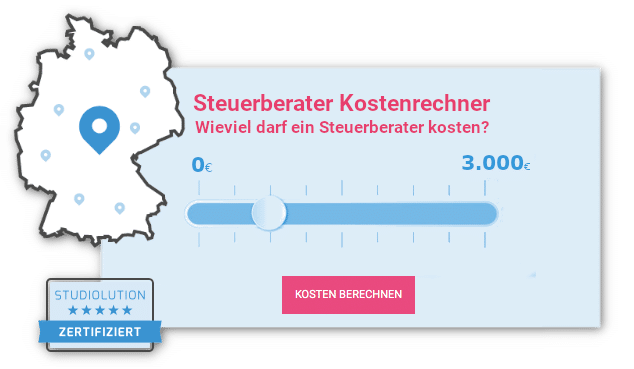

Tax consultant cost calculator

Our free tax advisor cost calculator helps you to calculate the range of your monthly and annual tax advisor costs – and all with just one click.

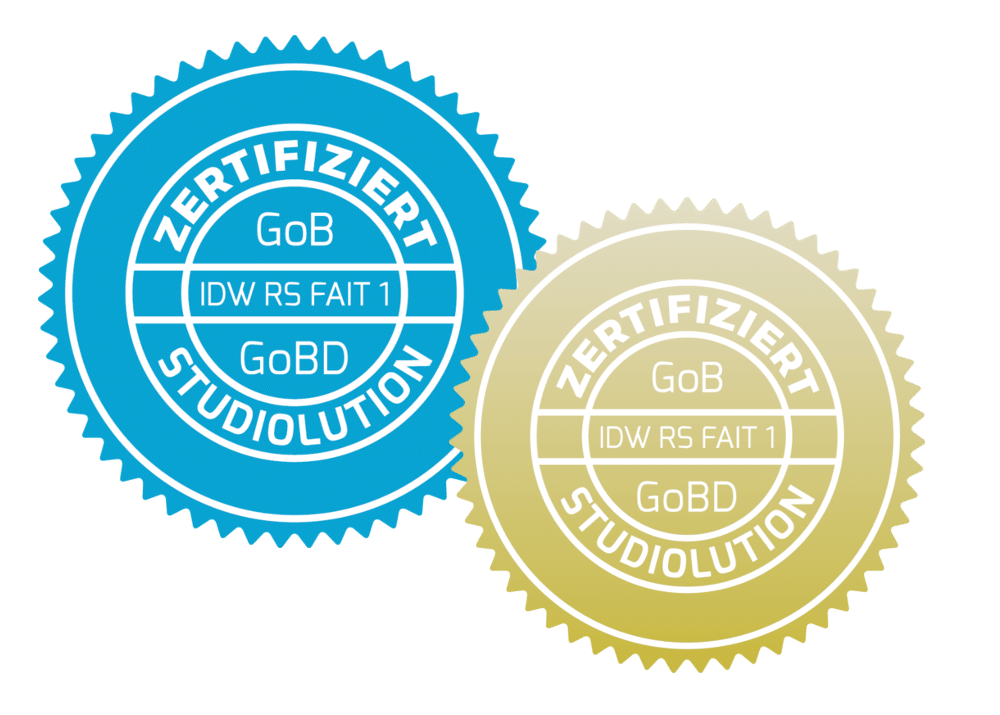

Certification

studiolution has been tested by independent auditors for the second time in a row and is certified according to the “Principles for the proper keeping and storage of books, records and documents in electronic form as well as for data access” (GoBD for short) of the German Federal Ministry of Finance.

Among other things, the following was tested:

Is an electronic cash register mandatory?

No! Many interested people call us and express that they have to change, because of the tax office. This is wrong. Theoretically, you can also continue to work with “shoebox and calculator”, since the GoBD do not apply to manual cash management. But that won’t get you anywhere – it won’t make you any better and won’t take the pressure off yourself or your tax office. You will also have less insight into your business and will still have to live with your “paperwork”.

Our tip: If you don’t use studiolution because you feel that you are being harassed by the tax office – we’ll help you.

but because you want to save time, become better and more effective and offer your customers more service.